HYBE, formerly Big Hit Entertainment, is facing scrutiny as netizens note that no female executives were ever granted stock options before the company’s 2020 IPO, a practice that benefited male executives and outside investors.

With the ongoing investigation against Bang Si Hyuk on alleged fraudulent trading, many have gathered their attention on the timeline of HYBE’s IPO in 2020. In the latest scrutiny, some noticed that key female executives in the company, including Choi Yoo Jung, Chae Eun, and Min Hee Jin, reportedly never received the stock they were promised.

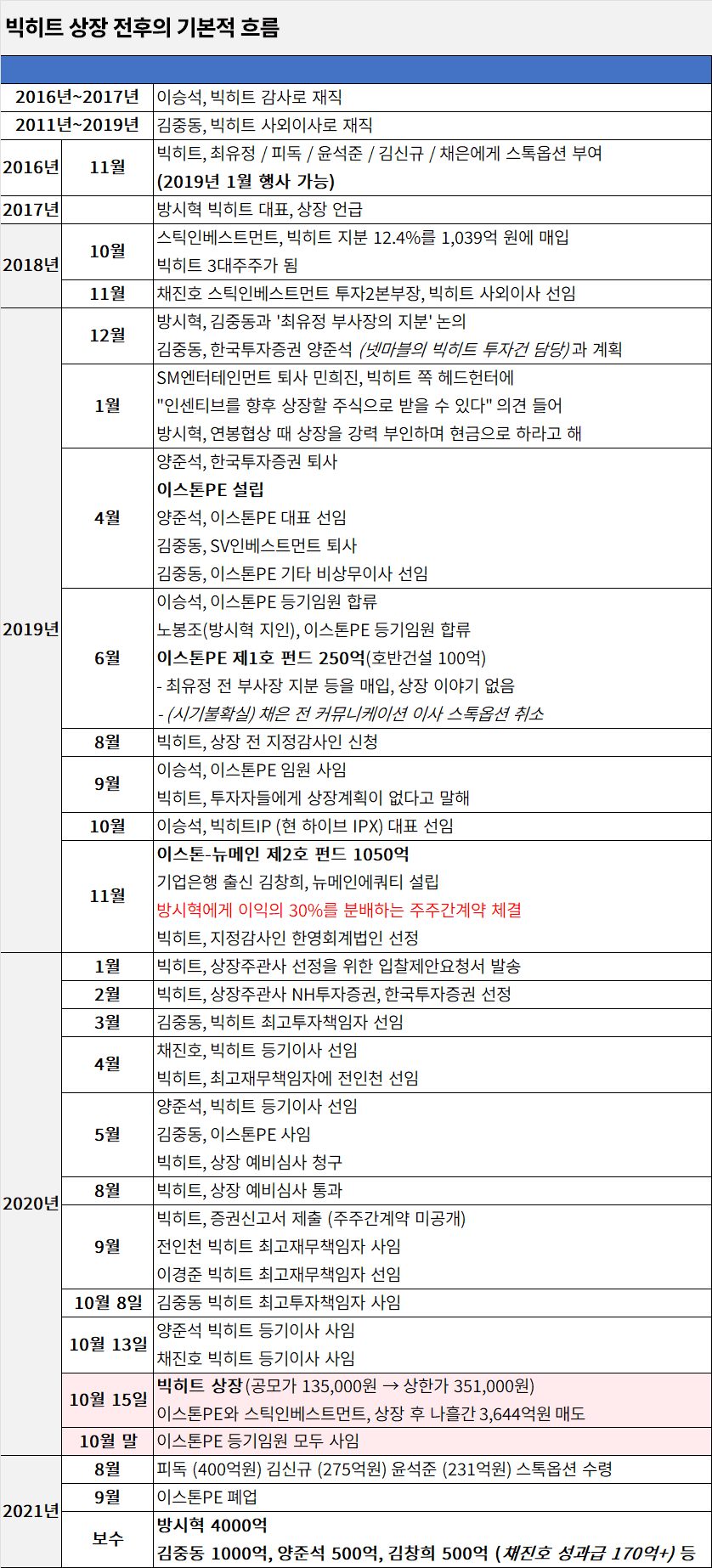

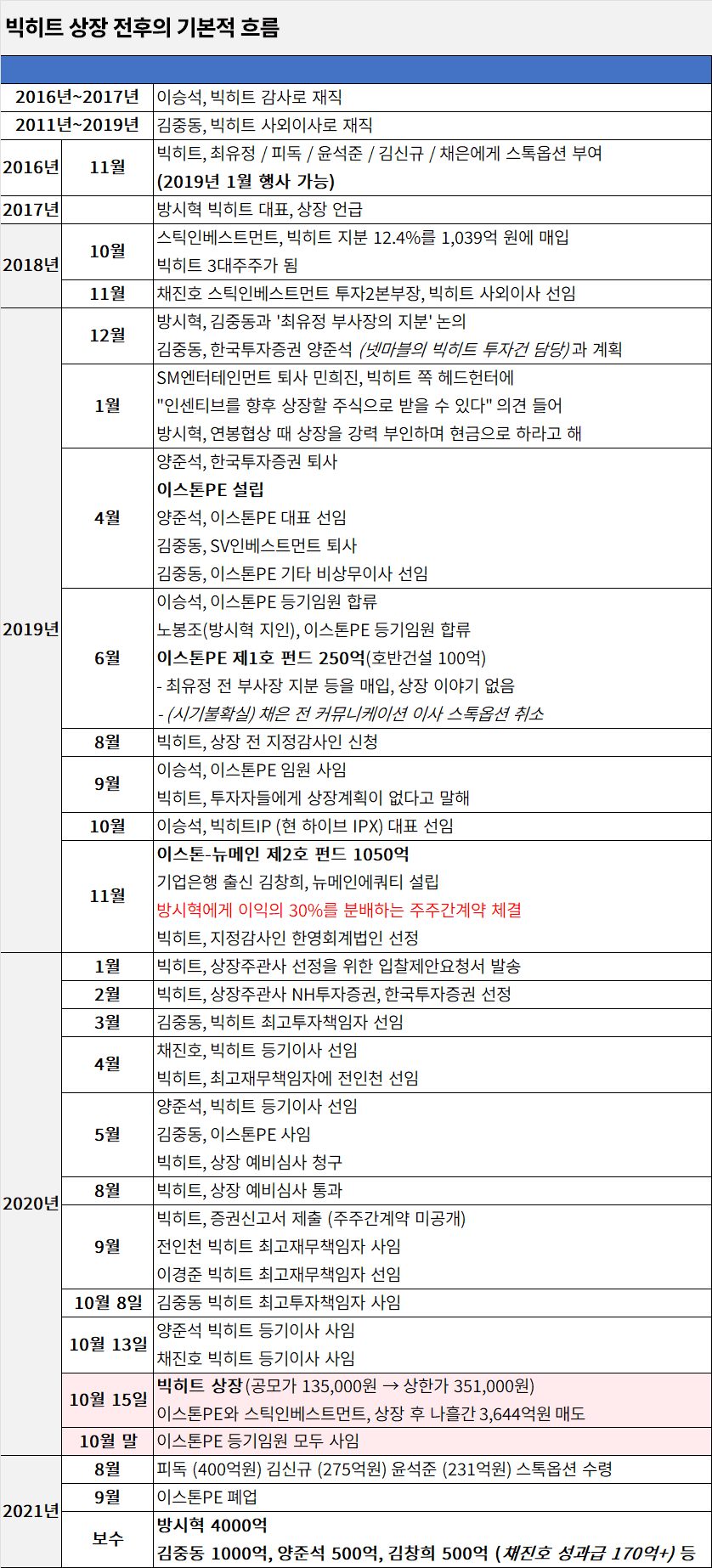

One netizen organized the timeline of HYBE’s IPO and listed the members who received stock options.

Translation:

The basic flow of Big Hit Entertainment before and after its IPO

- 2016~2017: Lee Seung Seok worked at BigHit as an auditor.

- 2011~2019: Kim Jung Dong served as an outside director at BigHit.

- 2016, November: BigHit granted stock options to Choi Yoo Jung, Pdogg, Yoon Seok Jun, Kim Shin Gyu, and Chae Eun (exercisable from January 2019).

- 2017: Bang Si Hyuk, CEO of BigHit, mentioned the IPO.

- October 2018: STIC Investment purchased 12.4% of BigHit shares for 103.9 billion KRW (~75.4 million USD), becoming BigHit’s third-largest shareholder.

- November 2018: Chae Jin Ho, STIC Investment Deputy Head of Investment, was appointed as BigHit outside director.

- December 2018: Bang Si Hyuk and Kim Jung Dong discussed “Vice President Choi Yoo Jung’s shares.” Kim Jung Dong planned with Yang Jun Seok of Korea Investment & Securities (who handled Netmarble’s investment in BigHit).

- January 2019: Min Hee Jin, who left SM Entertainment, told a BigHit headhunter that “incentives could be received in future IPO shares.” Bang Si Hyuk strongly denied the IPO during salary negotiations and insisted on cash.

- April 2019: Yang Jun Seok left Korea Investment & Securities and established Eastone PE, becoming its CEO. Kim Jung Dong left SV Investment and was appointed as a non-executive director at Eastone PE.

- June 2019: Lee Seung Seok joined Eastone PE as a registered executive. No Bong Jeo (Bang Si Hyuk’s acquaintance) also joined Eastone PE as a registered executive. Eastone PE Fund No.1 purchased 25 billion KRW (10 billion KRW from Hoban Construction) and Choi Yoo Jung’s shares; no IPO plans at that time (timing uncertain). Chae Eun’s stock options were canceled.

- August 2019: BigHit applied for a designated auditor before the IPO.

- September 2019: Lee Seung Seok resigned from Eastone PE. BigHit told investors that there were no IPO plans.

- October 2019: Lee Seung Seok was appointed head of BigHit IP (now HYBE IPX).

- November 2019: Eastone-New Main Fund No.2 raised 105 billion KRW (~76.2 million USD). Kim Chang Hee, formerly of Industrial Bank of Korea, established New Main Equity. A shareholder agreement was made with Bang Si Hyuk to distribute 30% of profits. BigHit selected Han Young Accounting Corporation as the designated auditor.

- January 2020: BigHit sent a Request for Proposal to select IPO underwriters.

- February 2020: BigHit selected NH Investment & Securities and Korea Investment & Securities as IPO underwriters.

- March 2020: Kim Jung Dong was appointed BigHit Chief Investment Officer.

- April 2020: Chae Jin Ho was appointed BigHit registered director. BigHit appointed Jeon In Cheon as CFO.

- May 2020: Yang Jun Seok was appointed BigHit registered director. Kim Jung Dong resigned from Eastone. BigHit submitted IPO preliminary review application.

- August 2020: BigHit passed the IPO preliminary review.

- September 2020: BigHit submitted the securities registration statement (shareholder agreement not disclosed). Jeon In Cheon resigned as CFO. Lee Kyung Jun was appointed BigHit CFO.

- October 8, 2020: Kim Jung Dong resigned as BigHit Chief Investment Officer.

- October 13, 2020: Yang Jun Seok and Chae Jin Ho resigned as BigHit registered directors.

- October 15, 2020: BigHit IPO (IPO price 135,000 KRW → upper limit 351,000 KRW). Eastone PE and Stick Investment sold KRW 364.4 billion worth of shares in the four days after the IPO.

- End of October 2020: All Eastone PE registered executives resigned.

- August 2021: Pdogg (40 billion KRW), Kim Shin Gyu (27.5 billion KRW), Yoon Seok Jun (32.1 billion KRW) received stock options.

- September 2021: Eastone PE closed.

- Rest of 2021: Bang Si Hyuk receives 400 billion KRW, Kim Jung Dong 100 billion KRW, Yang Jun Seok 50 billion KRW, Kim Chang Hee 50 billion KRW (Chae Jin Ho performance bonus 17 billion KRW), etc.

Based on a previous article published, Korean netizens discovered that key female figures were not given stock options, or were offered the option before the company went public, and the promise was not delivered.

Choi Yoo Jung, a production manager behind BTS’s ‘The Most Beautiful Moment in Life‘ album series and a co-founder of HYBE, sold her stock and left the company before the IPO. She told a reporter, “There was absolutely no talk about the IPO,” suggesting that even top executives were kept in the dark.

Netizens notice that no female executives of HYBE/Big Hit were ever given stock options

Posted by 7 hours ago 5,739

HYBE, formerly Big Hit Entertainment, is facing scrutiny as netizens note that no female executives were ever granted stock options before the company’s 2020 IPO, a practice that benefited male executives and outside investors.

With the ongoing investigation against Bang Si Hyuk on alleged fraudulent trading, many have gathered their attention on the timeline of HYBE’s IPO in 2020. In the latest scrutiny, some noticed that key female executives in the company, including Choi Yoo Jung, Chae Eun, and Min Hee Jin, reportedly never received the stock they were promised.

One netizen organized the timeline of HYBE’s IPO and listed the members who received stock options.

Translation:

The basic flow of Big Hit Entertainment before and after its IPO

- 2016~2017: Lee Seung Seok worked at BigHit as an auditor.

- 2011~2019: Kim Jung Dong served as an outside director at BigHit.

- 2016, November: BigHit granted stock options to Choi Yoo Jung, Pdogg, Yoon Seok Jun, Kim Shin Gyu, and Chae Eun (exercisable from January 2019).

- 2017: Bang Si Hyuk, CEO of BigHit, mentioned the IPO.

- October 2018: STIC Investment purchased 12.4% of BigHit shares for 103.9 billion KRW (~75.4 million USD), becoming BigHit’s third-largest shareholder.

- November 2018: Chae Jin Ho, STIC Investment Deputy Head of Investment, was appointed as BigHit outside director.

- December 2018: Bang Si Hyuk and Kim Jung Dong discussed “Vice President Choi Yoo Jung’s shares.” Kim Jung Dong planned with Yang Jun Seok of Korea Investment & Securities (who handled Netmarble’s investment in BigHit).

- January 2019: Min Hee Jin, who left SM Entertainment, told a BigHit headhunter that “incentives could be received in future IPO shares.” Bang Si Hyuk strongly denied the IPO during salary negotiations and insisted on cash.

- April 2019: Yang Jun Seok left Korea Investment & Securities and established Eastone PE, becoming its CEO. Kim Jung Dong left SV Investment and was appointed as a non-executive director at Eastone PE.

- June 2019: Lee Seung Seok joined Eastone PE as a registered executive. No Bong Jeo (Bang Si Hyuk’s acquaintance) also joined Eastone PE as a registered executive. Eastone PE Fund No.1 purchased 25 billion KRW (10 billion KRW from Hoban Construction) and Choi Yoo Jung’s shares; no IPO plans at that time (timing uncertain). Chae Eun’s stock options were canceled.

- August 2019: BigHit applied for a designated auditor before the IPO.

- September 2019: Lee Seung Seok resigned from Eastone PE. BigHit told investors that there were no IPO plans.

- October 2019: Lee Seung Seok was appointed head of BigHit IP (now HYBE IPX).

- November 2019: Eastone-New Main Fund No.2 raised 105 billion KRW (~76.2 million USD). Kim Chang Hee, formerly of Industrial Bank of Korea, established New Main Equity. A shareholder agreement was made with Bang Si Hyuk to distribute 30% of profits. BigHit selected Han Young Accounting Corporation as the designated auditor.

- January 2020: BigHit sent a Request for Proposal to select IPO underwriters.

- February 2020: BigHit selected NH Investment & Securities and Korea Investment & Securities as IPO underwriters.

- March 2020: Kim Jung Dong was appointed BigHit Chief Investment Officer.

- April 2020: Chae Jin Ho was appointed BigHit registered director. BigHit appointed Jeon In Cheon as CFO.

- May 2020: Yang Jun Seok was appointed BigHit registered director. Kim Jung Dong resigned from Eastone. BigHit submitted IPO preliminary review application.

- August 2020: BigHit passed the IPO preliminary review.

- September 2020: BigHit submitted the securities registration statement (shareholder agreement not disclosed). Jeon In Cheon resigned as CFO. Lee Kyung Jun was appointed BigHit CFO.

- October 8, 2020: Kim Jung Dong resigned as BigHit Chief Investment Officer.

- October 13, 2020: Yang Jun Seok and Chae Jin Ho resigned as BigHit registered directors.

- October 15, 2020: BigHit IPO (IPO price 135,000 KRW → upper limit 351,000 KRW). Eastone PE and Stick Investment sold KRW 364.4 billion worth of shares in the four days after the IPO.

- End of October 2020: All Eastone PE registered executives resigned.

- August 2021: Pdogg (40 billion KRW), Kim Shin Gyu (27.5 billion KRW), Yoon Seok Jun (32.1 billion KRW) received stock options.

- September 2021: Eastone PE closed.

- Rest of 2021: Bang Si Hyuk receives 400 billion KRW, Kim Jung Dong 100 billion KRW, Yang Jun Seok 50 billion KRW, Kim Chang Hee 50 billion KRW (Chae Jin Ho performance bonus 17 billion KRW), etc.

Based on a previous article published, Korean netizens discovered that key female figures were not given stock options, or were offered the option before the company went public, and the promise was not delivered.

Choi Yoo Jung, a production manager behind BTS’s ‘The Most Beautiful Moment in Life‘ album series and a co-founder of HYBE, sold her stock and left the company before the IPO. She told a reporter, “There was absolutely no talk about the IPO,” suggesting that even top executives were kept in the dark.

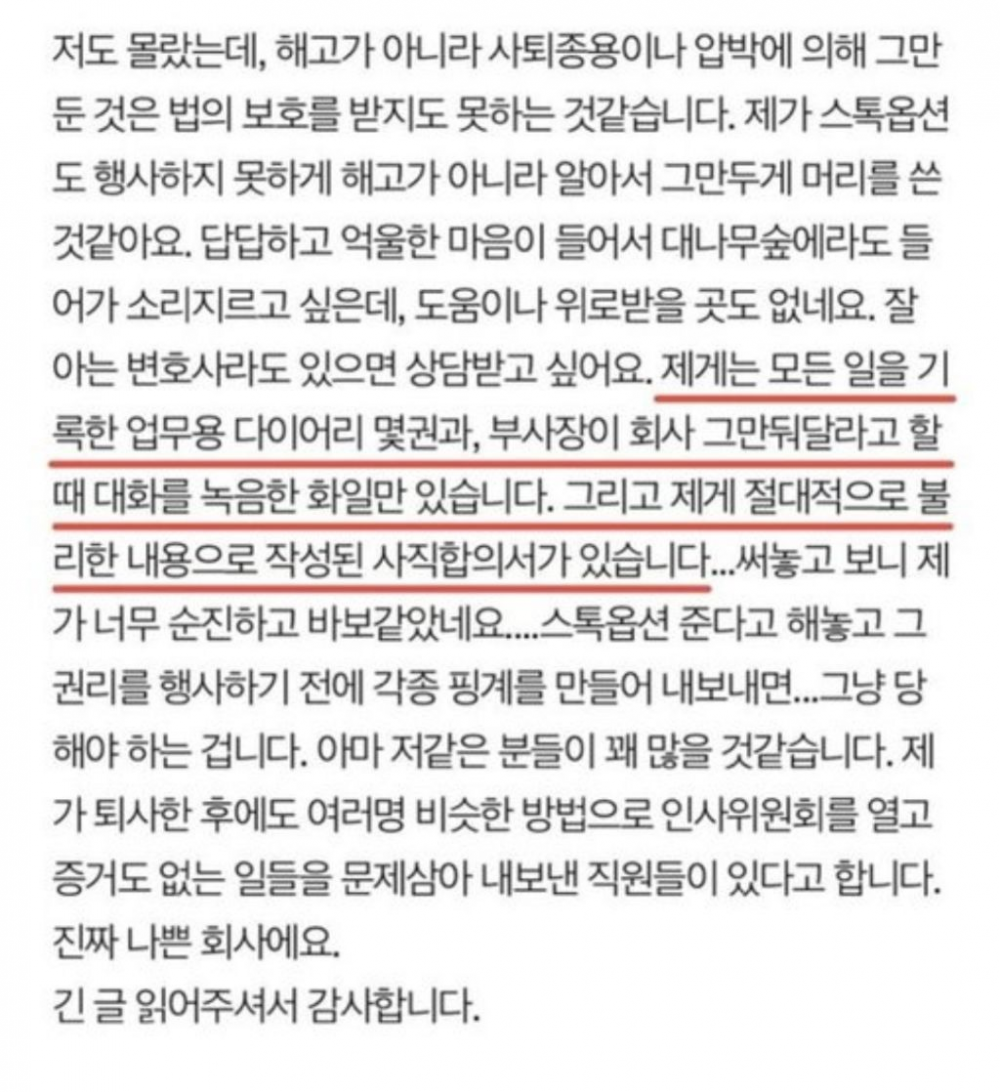

Moreover, Chae Eun, who played a central role in BTS’s expansion into the United States, stated that she was pressured to resign, preventing her from exercising her stock options. She explained, “They promise to give me stock options, but then make up excuses before I can exercise them… I think there are quite a few people like me.”

She gave a detailed account of her resignation and explained, “I didn’t know either, but it seems that quitting due to pressure or being encouraged to resign, rather than being fired, is not protected by law. It feels like they schemed to make me leave voluntarily so that I couldn’t exercise my stock options. I feel so frustrated and wronged that I want to go into a bamboo forest and scream, but there’s no one to turn to for help or comfort. I wish I could consult a lawyer I know. All I have are a few work diaries that document everything, and a recording of the conversation when the Vice President asked me to resign. I also have a resignation agreement written with terms that are absolutely unfavorable to me. Looking back, I realize I was so naive and foolish… They promise to give stock options, but then create all kinds of excuses before I can exercise them… and I’m just supposed to accept it. I think there are quite a few people like me. Even after I left, several employees were forced out through similar personnel committee meetings over issues with no evidence. This is truly a bad company.”

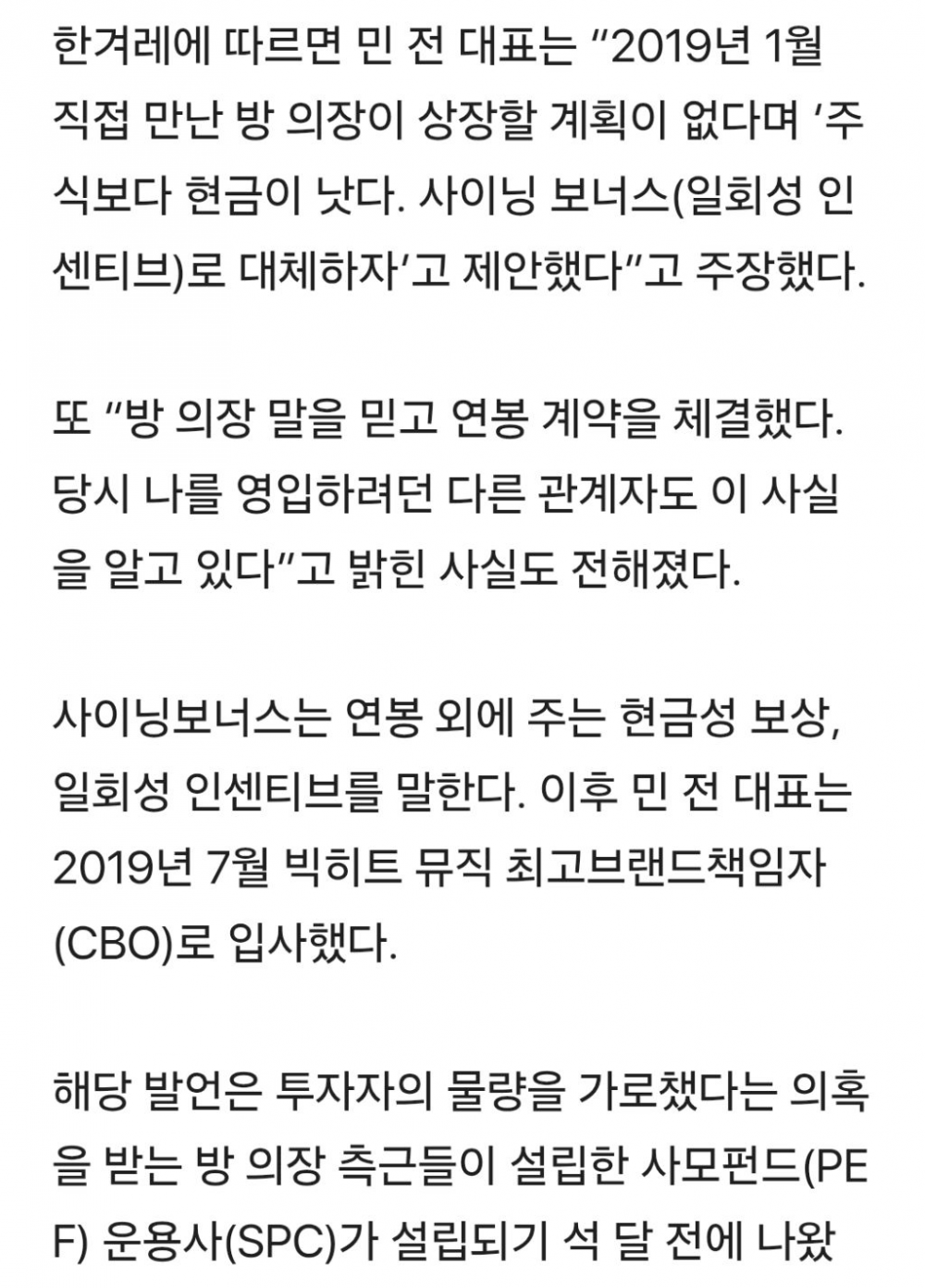

Former CEO of ADOR, Min Hee Jin, who briefly joined HYBE, also claimed that Chairman Bang Si Hyuk explicitly told her in January 2019, ““In January 2019, when I met Chairman Bang in person to negotiate my salary contract, he told me, ‘There are no plans to go public,’ and suggested, ‘Cash is better than stock for incentives. Let’s replace it (stock options) with a signing bonus.” She signed her annual contract under this assumption and later found herself restricted by a non-compete agreement, preventing her from exercising any stock options.

With more investigation, one netizen explained that the STIC Investment and Easton PE companies were private equity funds at the heart of the HYBE fraud case.

They added, “During this process, Bang Si Hyuk pocketed 30% of the private equity fund’s profits, which he used to buy a house in the United States.” They further explained, “STIC Investment and Easton PE are private equity firms (PEFs). They acquired Hybe’s shares in 2020 (then Big Hit Entertainment) before its IPO, through a shareholder agreement with Chairman Bang Si Hyuk. The agreement, which stipulated Chairman Bang’s guaranteed specific profits after the IPO, sparked controversy when it was revealed that they had purchased shares from existing investors who thought there were no plans to go public.”

The netizen accused, “After absorbing the shares of Big Hit Entertainment held by female executives and shareholders (allegedly without any plans to go public), the company abruptly and immediately closed in September 2021, just after the listing was completed, which is Investigative fraud.”

Korean netizens are baffled by the latest information and are speculating that Bang Si Hyuk had intentionally taken measures to take female executives out of the stock benefits.

They commented:

“I hope they get a real prison sentence + asset seizure as an example. Bang Si Hyuk is selling off the K-pop industry and the stock market lol. There was even talk that Big Hit should have been delisted because they failed to submit documents at the time, but they only got a verbal warning and moved on (I guess it went quietly because it was the Yoon administration?). Everyone must have known; it’s like a fixed game.”

“So they took the women’s money and divided it among the men?”

“They grew the company with women’s money and then threw out the women, lol.”

“HYBE is way too male-centered. They tried to divide women’s money among men? And the men weren’t even that capable.”

“HYBE keeps doing HYBE stuff consistently.”

“What a f*cker, hope he gets punished.”

“Really disgusting…”

“HYBE and Bang Si Hyuk are a cancer in K-pop. Pathetic, sly, and vile. I don’t know what they were thinking, being so cocky, but I hope they get punished and collapse.”

“I hope HYBE’s stock drops so people don’t invest again.”

“Classic old-man cartel.”

“They sucked money from women and filled the company with their sticky male executives. Truly ugly.”

“Reason I boycott HYBE.”

“They built the company with women’s money and then betrayed women to divide it among men. Disgusting.”

“They sucked women’s skills and money, then filled themselves up greedily. Wow.”